What’s on Your No-Buy List? How A Viral Trend Can Help You Spend With Intention

🤔 Could this trend help you save more?

Here’s what to expect in this newsletter!

(P.S. If this newsletter is cut off in your email just visit our Substack!)

📰 Interesting financial news: Stay up to date on what’s happening in the economy.

📈 What’s popping in the stock market: The 411 on trending/interesting stock market news.

📝 This week’s main topic: What this newsletter’s title is about!

🥰 Team CGF’s Amazon favs: Affordable yet helpful Amazon finds.

📰 Interesting financial news

Restart of student debt collections expected to trigger more student loan scams. (USA Today)

The average 401(k) savings rate hit a record high. See if you’re on track. (NBC News)

Why are more shoppers struggling to repay ‘buy now, pay later’ loans? (AP News)

📈 What’s popping in the stock market

Dollar General sees uptick in middle- and higher-income customers. (Ticker Symbol: DG)

Chime IPO: Should You Buy CHYM Stock? (Ticker Symbol: CHYM)

📝 Main topic: Have you started a no-buy list?

Summer is here, so you're probably considering buying a new swimsuit or a travel bag for your upcoming trip. While a new season often brings new purchases, this popular financial trend will have you thinking twice before swiping your card.

The "no-buy list" trend has taken over social media and has helped users save thousands of dollars. Some content creators have even estimated savings of around $5,000.

Let's dive into what to know about a no-buy list and how to make your own if you feel it's the right financial move for you.

What Is a no-buy list?

A no-buy list is simply a list of items you intentionally choose not to purchase for a period of time (or permanently). These lists often include things like fast fashion, takeout coffee, and trendy beauty products.

Overconsumption isn’t just a bad habit. Filling up your Amazon cart and ordering Uber Eats on a weekly basis are all things we do to cope with the stress of life. We all know how good it feels to bring a new gadget or outfit home.

Yet, this overspending can cause us to break our budget, clutter our homes, or, worse, accumulate debt.

Fortunately, a no-buy list can help you take control of your spending and make you feel confident about your purchases.

But as with any financial trend, there are positives and negatives. Let’s review.

No-buy list pros and cons

Although we’re fans of creating new habits to save money, every money-saving hack has its advantages and disadvantages.

Con: Doesn't work well if you're not intentional.

Whatever you add to your no-buy list, make sure it’s sustainable. Some content creators have shared items on their lists ranging from candles and dryer sheets to dried fruits.

For me, cutting out dried fruit isn’t practical because I love adding dried cranberries to my oatmeal and I often carry cashews for snacks when I'm on the go.

If your list isn't realistic, you might simply stop buying one item only to replace it with something else. For example, you might stop buying candles but then start buying plug-in air fresheners instead.

Additionally, it’s important not to make copycat lists. If someone has a list of 30 items, don’t feel you have to match that number.

Pro: Builds your confidence as a shopper

Even though I like buying new things, I've never been a big shopper. There are just too many decisions to make. Should I get the newest version of this tablet or one that is a little older but in my budget? Is the $40 vitamin C serum more effective than the $20 one? Will that fancy hair dryer really make my curls pop?

If you’ve experienced decision fatigue or realized buying a $50 moisturizer wasn’t worth the investment, then a no-buy list can help you relieve some of that stress. Having certain items on your no-buy list prevents the internal debate about buying something or not.

Your list is a constant reminder that your money is better saved than spent. You'll never regret the money you save.

Pro: Creates space for more meaningful spending aligned with your values

Often, we spend money out of habit or simply to fit in with social settings. How many times have we reached for a bag of Doritos and a Snickers bar when we stopped for gas? Perhaps you have a running tab at the local bar from weekly happy hour hangouts with your coworker. All those seemingly harmless expenses can add up.

When you identify and eliminate these "money leaks" with a no-buy list, you open up opportunities to enjoy life in ways that truly bring you happiness.

For instance, if you put alcohol or eating out on your no-buy list, you might start spending time with friends by hiking, taking a painting class, or going bowling.

Ultimately, a no-buy list empowers you to consciously decide what not to spend your money on, helping you align your spending with your broader financial goals, such as saving for a big trip, paying off debt, or building an emergency fund.

Now that you understand the pros and cons of a no-buy list, let's explore how to create your own.

How to set up your no-buy list

If you’re ready to start saving money, keep reading to put together a list that’s easy to stick to and easily syncs with your lifestyle.

1. Understand your "why" and how long you'll commit

When considering why you want to start a no-buy list, "saving money" is often the immediate answer. And, of course, that's a valid one! But let's dig a little deeper: What are you saving money for?

Perhaps you go shopping whenever you're bored and realize you need to curb your spending. Maybe you have a closet overflowing with handbags, unused paint kits, crochet needles, and other items you bought thinking they'd bring happiness—but they didn't.

As you compile your list, don't just focus on what you want to cut out. Instead, focus on the lifestyle you aspire to lead. Ask yourself: Will eliminating certain items genuinely help me reach my goals? Will buying fewer things allow me to be more organized?

Remember, when incorporating any financial strategy, it’s important to think of the long-term effects rather than just the immediate results.

2. Self-evaluate your spending

With a strong intention behind creating your no-buy list, it’s time to take a hard look in the mirror. Yet, instead of looking at your reflection, you’re going to look at your bank statements, grocery receipts, or anything that provides an account of your spending.

Let your spending data be your guiding compass as you build your no-buy list. For the most realistic picture of your money habits, categorize all your expenses from the last 30 days into "wants" and "needs." With this detailed list, ask yourself:

Did this purchase add value to my life?

Which purchases do I regret?

Did I make that purchase for myself or to impress others?

Why did I buy that?

Self-evaluate with compassion

During this reflection, remember to approach yourself with compassion. Shopping, after all, can often be a way to mask underlying feelings or emotions. If you frequently find yourself frequently popping into that boutique around the corner, consider whether you might be using spending to self-soothe.

Remember, evaluating your spending doesn’t mean depriving yourself of everything fun. Often, it simply means dialing back. For example, instead of buying coffee five times a week, you might make coffee at home and reserve those cafe visits for a special weekend treat.

The items on your no-buy list shouldn’t feel like you're making a life-altering sacrifice. Instead, focus on identifying items that realistically offer no value and are simply draining your money like a leaky faucet.

3. Set yourself up for success

Once your no-buy list is set, the next step is ensuring you stick with it. To do so, head to your email and social media accounts and unsubscribe or unfollow any person or business constantly tempting you with items on your no-buy list.

It might feel awkward hitting that unfollow button, but one small action can save you money and prevent future disappointment.

As you get rid of digital temptations, consider what other things might lead you to buy something on your no-buy list. For instance, if 'no buying coffee or eating out' is on your list, try eating before meeting friends for drinks. Alternatively, suggest a walk instead of hanging out at the bar.

Similarly, if ordering takeout is on your no-buy list, try meal prepping. This proactive step helps you avoid the temptation of ordering food after a long workday

Here are some other ideas to keep you motivated:

Set your no-buy list as your phone background or computer screensaver for a constant visual reminder.

Write out your financial goals and read them aloud daily.

Have an accountability partner.

Keep track of the money you save, or track how much you have spent. Allow these numbers to keep you motivated.

4. Redirect funds toward financial goals

As you notice your bank account staying pretty stable with your no-buy list, it’s time to start allocating those funds. Designating a specific place for your saved money is crucial to avoid inadvertently spending it. By funneling these savings into a dedicated account, like a high-yield savings account, you can break the cycle of saving and then immediately spending it.

5. Try out different types of no-buy lists

With your no-buy list, you can go cold turkey: no iced coffee, no manicures, and stick to that. Personally, I like to create no-buy lists that are a little flexible and adapted to what I need. Here are some ideas:

Weekly or monthly no-buy lists: These involve limiting spending for a shorter, defined period. For example, I might designate two or three weeks out of the month when I avoid buying those delicious cranberry and white chocolate cookies from the bakery.

No-buy list with exceptions: This approach allows for conditional purchases. For instance, 'no new skincare products until existing ones are finished' or 'no new books unless I donate a corresponding number of old ones.'

A reverse list: Instead of detailing what you won't buy, create a list of all the discretionary expenses you will budget for. Your 'fun money' list, for example, could include items like a weekend getaway, a wine-tasting experience, or an art class.

A wish list: This is one of my favorite financial practices. I create a list of desired items I want to purchase in the future. Once my necessary expenses are covered, I allocate money to buy one or two items on my wish list.

Why a no-buy might not work for you?

All of that said, a no-buy might not be for everyone. Learn more in this video!

So, what’s on your no-buy list?

We believe the key to sticking with any financial practice is making it enjoyable, and no-buy lists offer a fun, flexible way to save money.

Remember, with any new endeavor, you’re bound to make mistakes. Remember when you learned to drive? After bumping into some mailboxes and causing a couple of scratches trying to leave the parking garage, you didn’t give up on driving. You kept trying and got better. The same goes for saving money.

You might add something to your no-buy list and subconsciously buy it, and that’s okay. Keep following your list to the best of your abilities.

We’d love to know what’s on your list. Share your no-buy list in the comments below. And if you need more help saving money, you can check out our free course on savings challenges.

🥰 Team CGF’s Amazon Favs

It’s Friday night and you slouched on the sofa flicking through channels thinking that life could be better.

You want to make some changes in your life, but you don’t know where to start. Luckily we’ve got some books and resources that will help you start living a life with more peace, joy, and money.

P.S. If you make a purchase we may earn a commission, this helps us grow!

The Little Book of Hygge: Danish Secrets to Happy Living (The Happiness Institute Series)

We are told from a very young age that "stuff" will make us happy. As a result, we drive fancy cars, build extensions to our homes, and wait in line for hours to get the latest iPhone. Why? We believe a bright, shining new thing will make us happy or help us gain recognition.

Ironically, on the other side of the world, the Danish believe that hygge is the key to happiness.

Hygge—pronounced Hoo-ga—isn’t about accumulating material things. It’s about feeling safe and being surrounded by loved ones.

Think about those moments when you’re snuggled up on the couch with a warm blanket, sipping a cup of coffee, and listening to the rain outside.

Those moments when you're sitting around the table with family and friends, and time seems to stop and speed up at the same time because you’re so enthralled by the laughter and good conversations happening around you. This sublime feeling is hygge.

Those simple moments and the warm embrace are the things that truly make us happy, and The Little Book of Hygge shows you how to incorporate the simple pleasures of life into your daily routine.

In a fast-paced world, this book will teach you how to take a break, build and nurture meaningful relationships, and overall live life with more ease and joy.

The No-Spend Challenge Guide: How to Stop Spending Money Impulsively, Pay off Debt Fast, & Make Your Finances Fit Your Dreams

If you’re ready to kick your bad spending habits to the curb, then The No-Spend Challenge Guide is for you.

Author Jen Smith doesn’t just show you how to save money; she helps you understand the psychology behind impulsive spending. Through sharing her own experience of paying off $78,000 of debt in two years, you will learn how shifting your mindset is the key to better money management.

If you’re someone who:

Can’t seem to stick to a budget

Thinks you’ll never pay off your student loans

Is constantly wasting money

This book will help you erase your old patterns and habits and start saving money while still having fun.

Atomic Habits: An Easy & Proven Way to Build Good Habits & Break Bad Ones

Setting goals is great, however, if you don’t have the good habits to help you follow through on your goals, you can get stuck in a cycle of failure.

Atomic Habits offers a proven framework for daily improvement. James Clear, a leading expert in habit formation, shares practical strategies to help you build good habits, break bad ones, and master the tiny behaviors that yield remarkable results.

Struggling to change? The problem isn't you; it's your system. Bad habits persist not from a lack of desire, but from a flawed approach to change. This book provides a proven system designed to elevate you.

Weekly Magnetic Meal Planner Notepad

Is not eating out on your no-buy list? If so, planning out your at-home meals can help you resist the temptation to order in or grab takeout. Easily plan your meals for the week with the Meal Planning Notepad.

Stick it to the fridge and use it as your guiding light when preparing meals. It also has a tear-away shopping list so you know exactly what you need to buy to make some delicious meals. When you make your grocery list based on the meals you plan on making, you can be more intentional with your shopping.

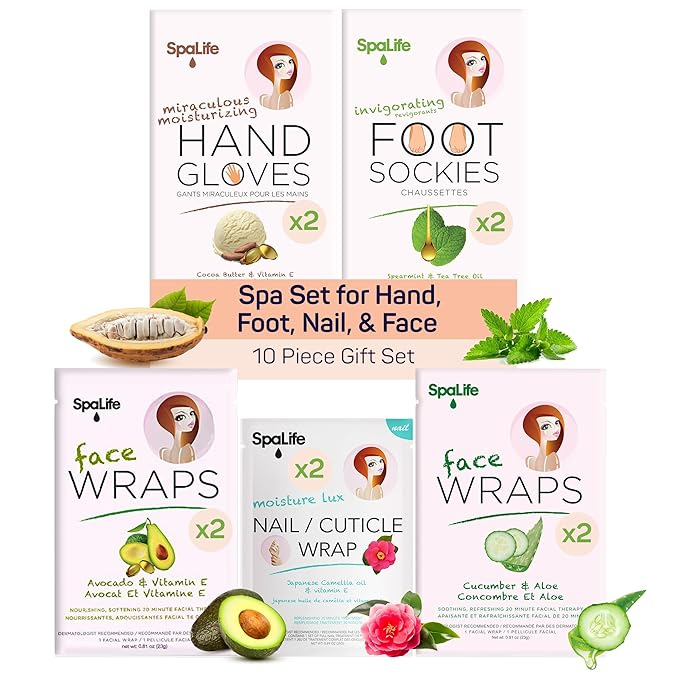

10 Piece At Home Spa Set

Trying to save money on manicures and pedicures? Ever thought of pampering yourself at home? With this 10-piece self-care kit, you can give yourself a relaxing home treatment for a fraction of the cost of going to a spa or salon.

Want smooth and hydrating skin? These kits come with face masks to leave your skin glowing. Looking for silky smooth hands? You can try on the moisturizing gloves.

No need to waste time and money driving to the salon for a foot treatment. Relax on your sofa while you read your favorite book and soothe your achy feet with moisturizing foot socks.

Self-care doesn’t have to be costly.