Let's Talk Emergency Savings + 2025 Tax Tips

📝 Practical advice on saving money and preparing your taxes

Here’s what to expect in this newsletter!

(P.S. If this newsletter is cut off in your email just visit our Substack!)

📰 Interesting financial news: Stay up to date on what’s happening in the economy.

📈 What’s popping in the stock market: The 411 on trending/interesting stock market news.

📝 This week’s main topic: What this newsletter’s title is about!

🥰 Team CGF’s Amazon favs: Affordable yet helpful Amazon finds.

📰 Interesting financial news

Nervous about home-buying in 2025? You're not alone. (USA Today)

Why you should never, ever store your credit card info in your internet bowser. (HuffPost)

The federal government is phasing out paper checks. Here's who will be affected. (NBC News)

📈 What’s popping in the stock market

Gold rises to another record as anxiety grips markets. Here’s what you need to know.

Etsy has erased its pandemic-era gains, but eBay has held up better. (Ticker Symbols: ETSY, EBAY)

YouTube could soon make more money than Disney, analyst says. (Parent Ticker Symbol: GOOGL)

What emotion is driving the stock market today? check out CNN’s fear and greed index.

This Index, created by CNN, is used to gauge the mood of the market. Many investors are emotional and reactionary, and fear and greed sentiment indicators can alert investors to their own emotions and biases that can influence their decisions.

📝 Main topic: It’s time to prioritize building your emergency savings: Key tips

According to an Intuit survey, Americans, particularly those ages 18 to 35, are financially stressed. 21% of respondents say their stress has worsened over the past year.

Why are people so stressed? Many factors contribute to stress, including rising housing costs, the high cost of living, and job instability. Moreover, 32% of Americans don’t feel equipped to handle emergencies such as car repairs, medical bills, and home maintenance.

About 45% of participants say these unexpected expenses are challenging, and 29% find it difficult to save money.

Different generations are saving money differently

Do you have an extra $1,000 to cover the cost of emergencies? According to a report by Bankrate that surveyed a little over 1,000 participants, older generations are most likely to have the cash on hand. On the other, only 32% of millennials and 28% of Gen Z adults have cash for unexpected expenses.

If you’re worried that one unfortunate event will leave you in financial ruin, it’s time to start prioritizing saving money.

How to start building your emergency savings

Saving money takes time, strategy, and consistency. Here’s what you need to get started:

1. Set a goal

Let’s start with how much you should save. The ideal amount should cover your necessary expenses for at least 3 to 6 months. This way, if you lose your job or can’t work, you can sustain yourself for a few months.

Calculate your savings goal

List all your mandatory monthly expenses, aka what you need to survive. Your list will most likely include rent, insurance, utilities, basic groceries, medications, etc. Remember to focus on your needs, not wants.

Add up the amounts to get the total monthly cost. Then, multiply that number by 3 or 6, depending on how many months you’ll need coverage.

Whatever the end number is, that is your savings goal.

For a clearer picture, you can also use an emergency savings calculator to determine this number.

2. Determine how much you can save

Your savings goal is likely high. According to a report by the Bureau of Labor and Statistics, the average monthly expense for households is $6,440. Multiplying that amount by three months and that’s an emergency savings goal of $19,320.

If your heart sank to your stomach, it’s okay. You don’t have to focus on saving that amount right away.

See how much you can realistically save each month.

The amount you can save each month will depend on your income and expenses.

Focus on setting small progress savings goals. If you can put aside $250 a month for 4 months, that’s $1,000. For the next 4 months, try saving $300 a month, to save a total of $1,200. Add that to your original $1,000, and you’ve saved $2,200 in 8 months.

Whether you're inching or sprinting towards your savings goal, your progress is what matters.

As you hit small milestones, continue to focus on your savings. Consider cutting back on other expenses or increasing your income with a side hustle.

Slowly saving can feel discouraging sometimes. But saving a little bit every month is better than not saving at all.

3. Learn to effortlessly save

The best way to save is to not think about saving. How do you do that? By automating your savings. Have a percentage of your paycheck go into your savings account every time you get paid.

Another way is by doing savings challenges or savings games. These activities help you to view saving money as fun rather than restricting.

Remember, our brains always prefer the easy thing. If putting aside money feels too hard, gamifying this task makes it easier to follow through.

Here are some ideas you can start with:

12 months of mystery saving. This is where you list out 12 areas to save money. Then, each month, you randomly choose one area to focus on.

A savings jar game. You focus on filling up a glass jar with cash by a certain amount of time.

Use a savings app. Many apps will help you save by tracking your spending. Some also offer coupons and discounts to certain stores.

4. Find a safe place for your savings

Now that you have a plan for saving money, let’s talk about where to keep your money so you’re not tempted to spend it. A regular savings account is fine, but make sure it isn’t attached to your checking account. This way, if you overspend, your savings won’t roll over to your checking.

High-yield savings account

A beneficial place for your cash is a high-yield savings account. These accounts work like a regular savings account, but they can help you save more money over time.

Let’s look at an example. Say you open a high-yield savings account with $1,000 earning 4% interest, compounded monthly.

If your savings plan is to deposit $300 a month, your balance would grow to approximately $4,705 after one year, including about $105 in interest.

Use an interest calculator

I don’t know about you, but I love talking about money but hate doing math. If you feel the same you can use an interest calculator to figure out how much you’ll earn in an interest-bearing account. Here are some of our favorites.

The great thing about a high-yield account is that you can easily access your money in an emergency. Most accounts don’t have withdrawal penalties.

If a high-yield savings account isn’t the right fit for you, focus on keeping your money in a place where you're not tempted to spend it. A certificate of deposit is a good alternative, but be sure to read the fine print.

5. Invest in insurance

Even though insurance is another expense, it can be a safety net for you in an emergency. Here are some different types of insurance to consider and how they can help you in the future.

Long-term disability insurance. This kicks in after short-term disability coverage ends. It can provide income replacement if you’re unable to work due to a serious illness or injury—whether it happened on the job or not.

Health insurance. If your employer doesn’t provide coverage, it’s important to explore your options. Health insurance can help reduce the financial burden of medical expenses, from routine care to emergencies.

Life insurance. This ensures your loved ones—like your children, spouse, or parents—are financially supported if something happens to you.

Homeowners or renters insurance. Whether you own or rent your home, this type of insurance protects your personal belongings from damage, theft, or unexpected disasters.

6. Stay ahead of the game

Even though we can’t control when an emergency will happen, we can do our best to prevent it. No, I’m not talking about magical spells and good luck rituals. By taking care of yourself, you can avoid many financial emergencies.

Take care of your health

Eating a balanced diet, exercising regularly, brushing and flossing your teeth can help you maintain your health. Likewise, it can help you avoid costly medical bills.

Get routine maintenance on your car

Whether it’s an oil change, rotating your tires, or changing your air filter, these routine tasks can keep your car in top shape. Even if they are annoying to do, buying a new engine or radiator will be a bigger annoyance.

Live within your means

Many of us spend money on things we don’t want or need. Living within your means and spending money on things you care about reduces expenses and saves you more money.

2025 Tax season tips

Tax season may be one of the most dreaded times of the year. If you’ve been putting off doing your taxes, here is a gentle reminder that doing your taxes may not be as difficult as you think.

With tax season in full swing, a tax refund can help you jump-start your emergency savings. If you haven’t filed yet, here are our tips to help you get started.

See if you qualify for free filing

While the IRS can be a scary entity, they do try to make some things easier for you. The IRS has a free filing system called Direct File. This system is only available in 25 states and requires users to meet the eligibility requirements. Yet, if you qualify, it could save you money.

The system is completely free and available in English and Spanish. If you don’t qualify, the website can point you in the direction of other free or low-cost services.

Check if you have an extension because of natural disasters

If you’ve recently experienced a natural disaster, such as the California wildfires, the IRS may have given you an extension to file and pay. You can see if you qualify by visiting the IRS website.

Take time to gather all necessary documents

The IRS will delay your processing if you are missing documents or have inaccurate information.

Refer to your prior year’s tax return as a guide for documents you need to collect. Be sure to follow up with your employer if you haven't received any tax forms.

To help me get through tax season, I like to break up my tasks. I set aside time to collect documents. Another moment to research filing options. Then, when it’s time to file, I block off time, put on my favorite album, and focus on filing.

Remember, once it’s done, you can focus on other areas of your life. And don’t forget to reward yourself once you’ve completed your taxes.

Saving money, and filing taxes are necessary parts of living a financially healthy life!

If you want to start building a better financial future, you can start with our free course on Savings Challenges. Learn new ways to save money and build financial security!

🥰 Team CGF’s Amazon Favs

In your quest to save money, we’ve got some tools that will make saving money easier. Check out our Amazon favorites to kick off your savings journey.

P.S. If you make a purchase we may earn a commission, this helps us grow!

Stainless Steel Piggy Bank for Adults

Here is a piggy bank that isn’t shaped like a pig! This stainless steel piggy bank that can store around 3,000 coins or 500 paper bills at full capacity is a great place to keep emergency cash on hand.

The sturdy piece of metal is an “only in, not out” piggy bank. This means after you deposit your money, you’re not tempted to stick your hand into the safe to grab some cash to tip your Uber Eats delivery person.

When you do need your money, you’ll have to break it to open it. Nothing like breaking open your piggy bank to bring back a little nostalgia.

Clever Girl Finance: The Side Hustle Guide: Build a Successful Side Hustle and Increase Your Income!

As we mentioned before, one of the best ways to increase your savings is by increasing your income. You’ve probably been eyeing The Side Hustle Guide, for a while now. It’s probably hanging out in your Amazon cart, ready to be added to your library.

If you’re worried you don't have the skills or abilities to run a successful side hustle, this book will help you. Within the pages, you’ll learn how to overcome your self-doubt and identify what you need to focus on.

Even if you’ve tried and failed to build a side hustle in the past, this book will help you learn from your mistakes. With knowledge, you can build a solid foundation for a new business.

Go from idea to creation, to planning, branding, marketing, and growing your business. Don’t overthink it. Use the Clever Girl Finance, Side Hustle Guide book to discover how you can make some extra money.

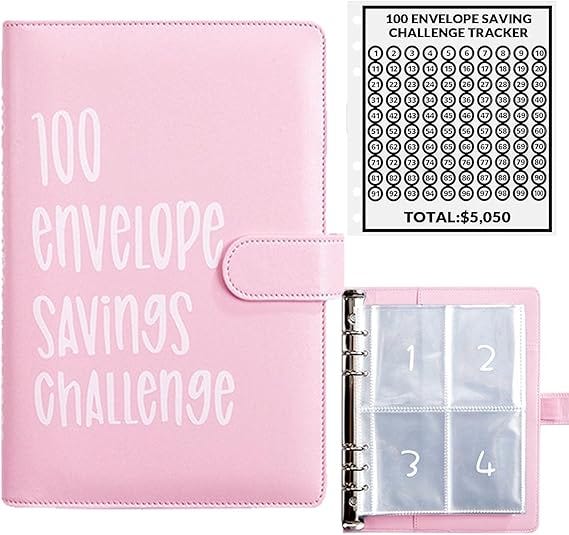

100 Envelope Challenge Binder

Want to save $5,050 in 100 days? All you need is to follow the 100 Envelope Challenge, and this 100 Envelope Challenge Binder will help you reach your goal. Great for visual learners, this elegant yet durable binder has 100 envelopes where you will store your cash for a hundred days.

Envelopes are labeled with a number. Every day of the challenge, you choose an envelope, and whatever number is on the envelope, that is the amount of cash you put in.

The binder is handy because it keeps all your money in one place, and you don’t have to worry about keeping track of 100 different envelopes.

I like this binder because you can organize your money in a visually appealing way. Seeing your money neatly displayed can keep you motivated to add more to your savings.