Girl Math, Huh?...Here's A Better Way To Stop Impulsive Spending

Sharing our thoughts on this financial trend

Girl Math is the new financial trend on social media, which, despite its title, can be applied to both women and men.

While this new trend is meant to be a joke and a fun way to talk about money, it can derail your finances and cause you to overspend if used regularly.

Here’s what you need to know about this trend and how to empower yourself with financial education.

What is “girl math”?

Girl math consists of making internal calculations based on time, money, and convenience to justify certain purchases or behaviors. For instance, girl math calculations could apply to:

Buying items you don’t need so that you can qualify for free shipping.

Purchasing an unnecessary item to get a sale.

Seeing anything under $5 as being free, so it’s okay to buy it.

Considering anything you buy in advance as free e.g. you buy concert tickets now and when you go in a month, it feels free

Girl math sounds a bit silly, right? Well, it kind of is. Yet thousands of people have enjoyed sharing which purchases they applied girl math to.

Can girl math do more harm than good?

Yes, girl math can derail your finances if unchecked. It also reinforces the belief that women, specifically, are bad with money. Even though research shows that both men and women make impulsive buys; and some studies show that men even impulse shop more than women!

Although everyone has made impulsive purchases at some point in their lives, it’s important to keep those in-the-moment purchases to a minimum. Stop throwing your money away and explaining it with girl math, and focus on learning better financial habits.

7 Tips to control your impulsive spending

We all have our reasons for making impulsive purchases. Sometimes, it’s because of stress, lack of financial education, or having a budget that is too strict.

Yet, always making excuses won’t help you to be better with money. Instead, here are some tips that will help you make better financial choices.

1. Avoid temptation

One of the best ways to avoid impulsive buying is to avoid those stores that always have a sale going. You know, the ones that boast about their “buy now, pay later” deals?

When you’re bombarded with 50% off deals or the best sale of the year, it’s easy to give in to these temptations. Avoiding them altogether by not going to the mall or certain stores and blocking access to your favorite online shopping platforms is best.

Alternatively, if you want to shop, create a wishlist of items, give yourself time to think about them and then find the best deals on the items you actually want.

2. Stop and consider

Before you click add to cart or walk over to the checkout line, take a moment to think, do I really need this item?

We know the girl math point of view might say that if you don’t buy this item on sale, you’ll be missing out. You’re not alone in this fear; up to 53.8% of people indulge in impulse buying due to a fear of passing up a bargain or sale.

What do you do with all that fear and anxiety? You pause and give it a day to see if the desire stays with you. If the urge persists, consider reallocating funds within your budget to accommodate the purchase. However, most of the time, the desire fades once you wait it it out.

3. Create and follow a budget

Prioritize budgeting is one of the foundations of strong financial planning and there are many different budgeting types to choose from. When deciding on which budget is right for you, make sure that you allocate funds for emergency savings, debt repayment, essential expenses, and life aspirations.

If you find out you have more than enough money to cover your most essential expenses; you can add a category to your budget for “guilt-free or fun“ spending. With this added section, you can allocate money for personal expenses without damaging your budget.

4. Think about what motivates you to make an impulsive purchase

Have you ever thought about why you make impulsive purchases? Perhaps it has to do with external perceptions. Does buying new clothes, gadgets, or accessories make you the center of attention among people in your social group? Do you feel pressure to make certain purchases to fit in?

Perhaps you impulsively buy because you are stressed, and purchasing something gives you a quick sense of relief or control.

Take a moment to reflect on why you often reach for your credit card. When you can identify the underlying motivation, you can change your behavior.

If you shop when you are stressed, consider taking up a new hobby, such as running, to relieve your stress. If you shop for social reasons, try finding new friends who aren’t focused on spending money

5. Limit your cash and credit

Next time you have a night out, consider only carrying cash. This way, you can determine how much you want to spend and be more conscious. Research suggests that credit card users spend as much as 83% more than those who use cash for purchases.

If online shopping tends to be your Achilles’ heel, consider freezing your credit cards. You can do this by reaching out to your credit card issuer directly.

6. Stay off social media

The social aspect of social media is being replaced by product placement and the influencer market. It’s nearly impossible to scroll through social media without seeing numerous advertisements, which isn’t an accident.

Studies indicate that personalized ads assist individuals in discovering 49% of products and services relevant to their interests. If you don’t want to become part of a statistic, the most effective approach is to limit social media, utilize an ad blocker or do a social media detox.

7. Remind yourself of your financial goals

What are your financial aspirations? Do you want to retire early, save for a vacation, or buy a new car? Whatever your goal may be, to achieve it, you’ll need to apply some discipline with your spending.

While occasionally splurging seems okay, each impulsive purchase can chip away at your progress if you’re not careful. Those in-the-moment decisions can prolong debt repayment and hinder the growth of your emergency savings.

When you think about it, is the satisfaction of buying an outfit on sale worth sacrificing your financial goals?

We share with you these tips, not to say you can never treat yourself. After all, having fun money as a part of your budget is important and restrictive budgeting can lead you back to overspending.

Applying these insights makes it easier to sidestep future impulsive purchases and instead put your money towards things that matter!

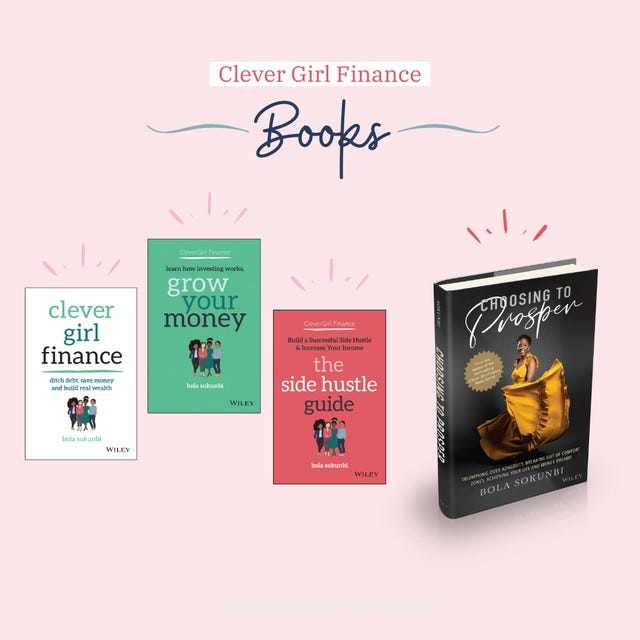

Need more support with curving your spending habits? Check out our book series and our completely free courses.